In the last quarter of 2016 HLB McKeogh Gallagher Ryan again fundraised for two separate wind farm projects – Cahermurphy Windfarm in County Clare and Garrymore Windfarm in County Donegal – and found investors have a growing appetite for tax relief schemes and continue to appreciate the simplicity of the wind farm model.

In the last quarter of 2016 HLB McKeogh Gallagher Ryan again fundraised for two separate wind farm projects – Cahermurphy Windfarm in County Clare and Garrymore Windfarm in County Donegal – and found investors have a growing appetite for tax relief schemes and continue to appreciate the simplicity of the wind farm model.

In the last quarter of 2016 HLB McKeogh Gallagher Ryan again fundraised for two separate wind farm projects – Cahermurphy Windfarm in County Clare and Garrymore Windfarm in County Donegal – and found investors have a growing appetite for tax relief schemes and continue to appreciate the simplicity of the wind farm model.

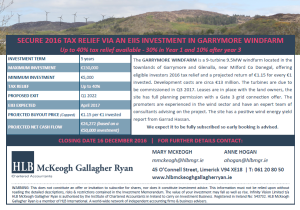

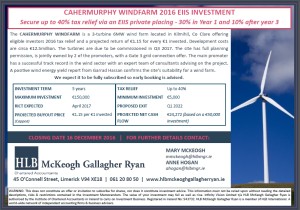

Speaking about their 2016 fundraising success Tax Partner Mary McKeogh noted: “We stuck with our traditional approach of fundraising for solid wind farm projects which already had the fundamentals in place such as power purchase agreements, full planning permission, bank Heads of Terms and Gate 3 grid connections. All of which meet our investors’ desire for conservative, well-managed projects with clear projections and investor exit strategies.

“Again this year both promoters opted for five year investment terms to ensure they had sufficient time to build up the required cash reserves to buy out the EIIS investors. They offered investors a projected buy out price of €1.15 per €1 invested so that when combined with the tax relief it offered investors good value for money.”

|

|

|

Garrymore EIIS Windfarm Investment |

Cahermurphy EIIS Windfarm Investment |

From a fundraising point of view 2016 was a very competitive year with a number of new EIIS funds launched as well as an increase in smaller private placing options. This all points to a further strengthening of the economy as people start to have excess income they wish to shelter from the higher rate of tax. Also more options for investors are good for promoters as they generate more interest and awareness of the EIIS and good projects will always stand out.

Figures released from Revenue show that more than €108m was invested in EIIS from over 2,000 investors in 2016, which is a 46% increase on the amount invested in 2015. The scheme was used by 261 small and medium sized companies to raise finance continuing the upward trend in the amounts raised through the scheme.

Tax Partner Mary McKeogh(L) with Associate Tax Director Anne Hogan(R)

Having raised EIIS investment for wind farm projects since the scheme’s launch in 2012 we have noticed an increased awareness and sophistication in investors year on year. They ask probing technical questions about the wind farms – from a financial and operational point of view – and also research the promoters and assess their track record before committing to an investment. Our Tax Director Anne Hogan spends November and December dealing with these queries: “Investors really investigate the detail of a project before investing. We believe in a transparent and full disclosure approach when dealing with investors, providing the relevant financial information, encouraging them to speak to promoters directly who have a better grasp of the operational side of the project, as well as providing sight of legal documents such as the investment agreement and put and call agreement, if required or requested. Having the correct legal and financial structures in place to protect the EIIS investors is very important, that is why we always have a separate legal firm representing the investors and protecting their interests when the investment is being structured.

Not to rest on our laurels we are already sourcing new EIIS projects for 2017; any interested promoters should contact us as soon as possible as we carefully vet projects in the first half of the year before committing to fundraising.”

Any companies interested in engaging in EIIS fundraising or simply structuring an EIIS investment, where investors have already been sourced, should contact HLB McKeogh Gallagher Ryan’s Tax Partner Mary McKeogh mmckeogh@hlbmgr.ie or Associate Tax Director Anne Hogan ahogan@hlbmgr.ie who would be happy to discuss their requirements further.