Have you secured your 2015 EIIS all-income tax relief?

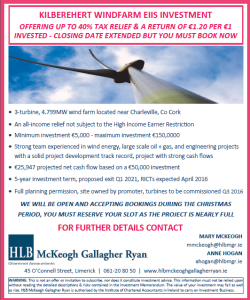

Final call for the Kilberehert EIIS Windfarm Investment offering all-income tax relief

Our office is open over Christmas – we are accepting applications and will be available to respond to queries. Please e-mail your query to ahogan@hlbmgr.ie or you can leave a voice mail on 061 208050 and we will revert to you over the Christmas period.

KEY STATS – KILBEREHERT WINDFARM

|

|

|

- Tax relief: Up to 40% (30% + 10%)

|

- Maximum investment: €150,000

|

- Minimum investment: €5,000

|

- Projected buyout price: €1.20 per €1 invested

Capped on exit |

- Projected net cash flow*: €25,947

*Based on an investment of €50,000 |

- RICT expected: April 2016

|

|

|

CLOSING DATE EXTENDED BUT WE WILL CEASE ACCEPTING APPLICATIONS ONCE FULLY SUBSCRIBED CLOSING DATE EXTENDED BUT WE WILL CEASE ACCEPTING APPLICATIONS ONCE FULLY SUBSCRIBED

FOR QUERIES DURING THE CHRISTMAS PERIOD PLEASE CONTACT

ANNE HOGAN

Director

ahogan@hlbmgr.ie

061 – 208050

|

Back